On December 17, 2020, Law No. 1054, “Signage Law,” was published in La Gaceta, Official Gazette No. 234. This law aims to regulate advertising and publicity carried out through signs located in the municipalities throughout the national territory.

Prior to the publication of Law No. 1054, advertising and publicity were regulated for the Municipality of Managua under Article 21 of Decree No. 10-91 “Municipal Fee Plan of the Municipality of Managua,” and under Article 44 of Decree No. 455 “Municipal Fee Plan” for the rest of the municipalities in the country. These articles mainly established the applicable tax rate for signs, which ranged between C$30.00 and C$200.00. Such articles were repealed by the new Signage Law.

Until the entry into force of the Signage Law, each municipality, through municipal ordinances, regulated and established special treatment regarding this tax, so this new law in some way unifies the specific regulations of each municipality in the country into a single legal framework.

What should be understood by SIGN?

According to the Law, a “sign” is “the structure, element, or technological means used for the placement and display of advertising in a public or private area, either permanently or temporarily.”

Are there exceptions?

Yes. Law No. 1054 establishes that the following types of signs are not regulated by its provisions:

-

- When they are installed inside buildings and are not visible from the outside.

-

- Signs installed by individuals at their homes to indicate their profession or trade. In such cases, the dimensions of these signs may not exceed 0.50 square meters.

What tax must I pay and when is it paid?

The law establishes a series of parameters that must be taken into account when paying the sign tax. These are the following:

-

- Territorial location: The tax amount depends on the classification or category of the municipality (the classification of municipalities ranges from A to F and depends on their annual income).

-

- Type of sign: Signs may be attached to buildings, fixed to the ground, mobile, or temporary. The technical specifications determining the type of sign will be regulated in the Regulations of the Law, which, as of the publication date of this article, have not yet been published in La Gaceta, Official Gazette.

-

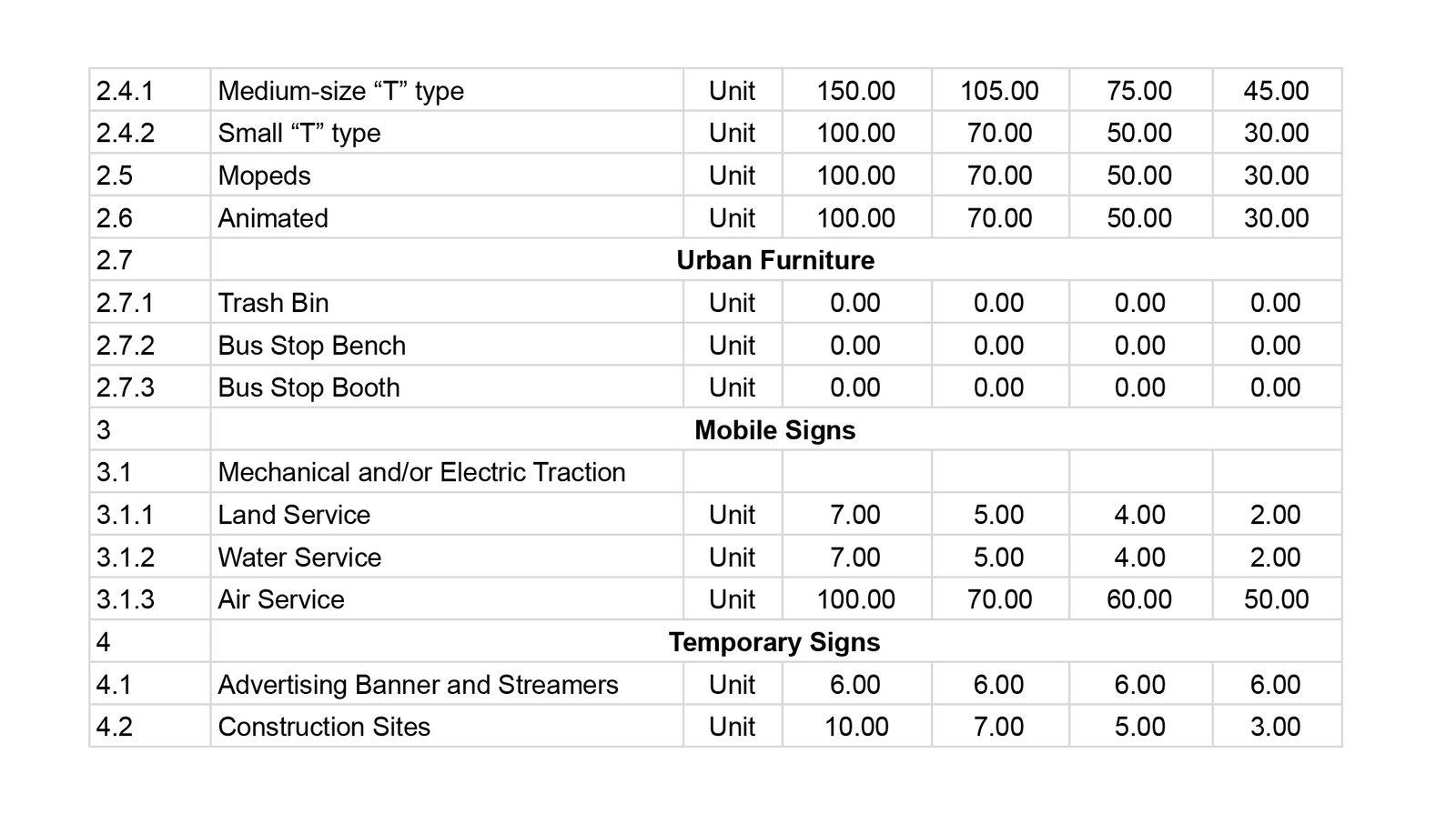

- Size or quantity: This will depend on the type of sign according to the table indicated below.

Below is the table contained in Article 13 of the Law, indicating the rate to be paid according to the conditions described above:

The sign tax must be paid in January of each year at the corresponding municipality. If the tax is not paid within the established period, a 5% fine will be applied to the amount of the tax.

And just by paying the tax, can I already put up my sign?

No, anyone who wishes to install a sign must process and obtain an “installation permit,” which is valid for one calendar year and must be renewed annually. To do so, the applicant must be up to date with all municipal obligations; otherwise, the permit or its renewal will be denied.

The permit itself has no cost, unless it involves:

-

- Installation of mega signs.

-

- Installation in public spaces for signs fixed to the ground.

In the case of mega sign installations, a supervision fee must be paid for the installation, which has a value of USD 100.00. In the case of using public space for signs fixed to the ground, a fee equivalent to 5% of the applicable annual sign tax must be paid.

Mass Signage Tax

In addition to the fees mentioned above, the Signage Law establishes the so-called “Mass Signage Tax,” which must be paid by large taxpayers who place temporary signs massively at distribution points. These taxpayers must pay USD 4.00 annually for each distribution point.

Exemptions from the Law

It is important to mention that Law No. 1054 includes exemptions from the sign tax for certain entities and activities, such as an exemption for new micro and small businesses during their first year of operation, provided that the sign does not exceed 10 square meters in size. Other exemptions include:

-

- Centralized and decentralized institutions, autonomous entities, state-owned enterprises, regional governments, territorial governments of indigenous peoples, indigenous and Afro-descendant communities

-

- Red Cross

-

- Fire departments

-

- Public health units

-

- Churches and religious denominations with legal status, as long as the advertising serves the purposes for which they were created

-

- Municipal entities in accordance with Law No. 40, Municipalities Law and its Regulation

-

- Artistic expressions such as paintings or murals, as long as they do not contain commercial messages

It should be noted that, although the entities and activities listed above are exempt from paying the Sign Tax, they are still required to obtain the corresponding installation or renewal permit.

The Law establishes a series of penalties for non-compliance with its provisions, ranging from fines equivalent to 100% of the unpaid tax to the removal of signs.

An update on this Law will be published once its regulation is officially released.